Understanding Medicare: A Comprehensive Guide

Medicare is a federal health insurance program that provides essential medical coverage to millions of Americans. Established in 1965, this primarily serves individuals who are 65 years and older, although it also covers younger people with specific disabilities and those with End-Stage Renal Disease (ESRD). As one of the cornerstones of the U.S. healthcare system, this ensures that eligible individuals have access to necessary medical services, thereby promoting better health outcomes and financial security.

Who is Eligible for Medicare?

Eligibility for Medicare is determined based on several criteria. Firstly, individuals who are 65 years old or older are generally eligible. In addition to the age requirement, one must be a U.S. citizen or a legal permanent resident for at least five consecutive years. Importantly, many individuals automatically qualify for Medicare Part A (Hospital Insurance) without a premium if they or their spouse paid Medicare taxes for at least 10 years.

Besides those who qualify by age, younger individuals can also be eligible for Medicare insurance. Specifically, people under 65 can receive Medicare if they have been receiving Social Security Disability Insurance (SSDI) for 24 months or have a qualifying disability such as Amyotrophic Lateral Sclerosis (ALS). Additionally, anyone diagnosed with End-Stage Renal Disease, requiring dialysis or a kidney transplant, qualifies for Medicare irrespective of their age.

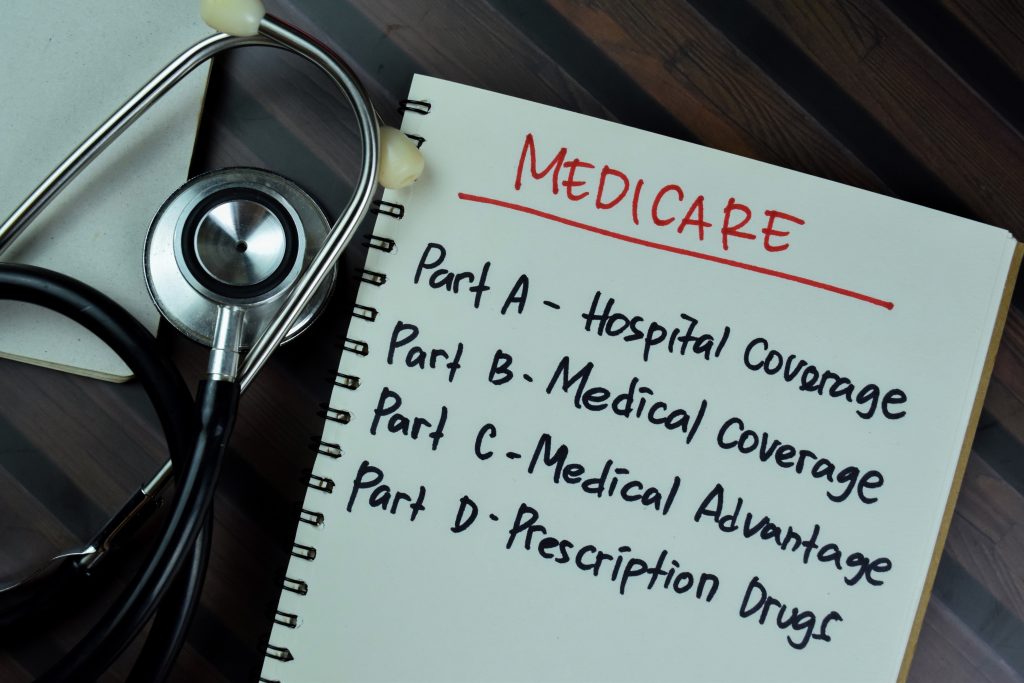

Breaking Down Medicare Parts

Medicare is divided into four parts, each covering different aspects of healthcare:

1. Part A: Often referred to as hospital insurance, Part A covers inpatient hospital stays, skilled nursing facility care, hospice care, and some home health care. Most beneficiaries do not pay a premium for Part A if they meet the work history requirements.

2. Part B: This part covers outpatient care, doctor visits, preventive services, and certain home health services. Unlike Part A, Part B requires a monthly premium, which varies based on income.

3. Part C (Medicare Advantage): Part C plans are offered by private insurance companies approved by Medicare. These plans provide all Part A and Part B benefits and often include additional coverage, such as vision, dental, and prescription drugs. Medicare Advantage plans typically have network restrictions and may require referrals for specialists.

4. Part D: This part focuses on prescription drug coverage. Part D plans are also provided by private insurers and help cover the cost of prescription medications, protecting beneficiaries from high drug costs.

Enrolling

Enrolling in this can seem daunting, but understanding the enrollment periods and requirements can simplify the process. Initial Enrollment Period (IEP) begins three months before an individual turns 65 and ends three months after their birthday month. For those who miss the IEP, the General Enrollment Period (GEP) from January 1 to March 31 allows for sign-ups, with coverage starting July 1. Special Enrollment Periods (SEPs) are also available for those who qualify due to specific life events, such as losing other health coverage.

Conclusion

In conclusion, This is a vital program that provides healthcare coverage to older adults and individuals with certain disabilities or medical conditions. By understanding who is eligible and the different parts of Medicare insurance, beneficiaries can make informed decisions about their healthcare. Navigating this can be complex, but with the right information and resources, individuals can ensure they receive the coverage they need.